Which three options are available if a component already exists in the target environment, when you import a statement definition?

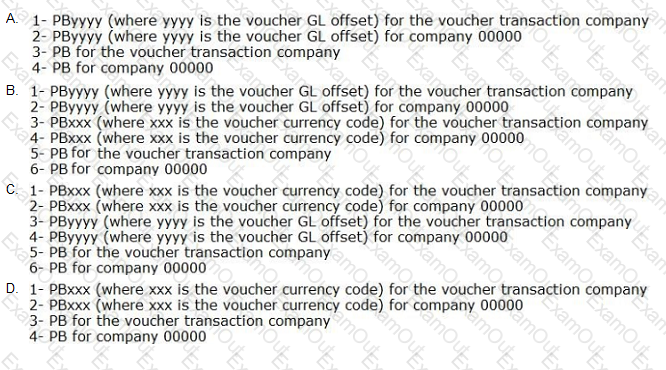

Which Automatic Accounting Instruction (AAI) hierarchy determines the GL Bank Account when you add a new voucher?

Your client has decided to use journal entries to create budgets in the system. After journaling the budgets, they have found the records in the F0911 table but cannot locate the balance in the F0902 table.

Where are the balance records contained in the F0902?

What three AAIs can be set up for revenue recognition?

Your client wishes to run Calculate Withholdings Report In preparation for the payment process. For the Calculate Withholding program to select a voucher, what must the voucher's pay status be?

Which of the following is NOT an element of Asset Depreciation?

Your client wants you to help them define their business units. Which statement is TRUE regarding business units?

Your client requires that their A/P department not pay duplicate supplier Invoices. Which action will prevent users from entering duplicate invoice numbers?

You were asked to map the different category codes in the Address Book, Business Unit Master and Account Master. Which of the following statements is TRUE?

Your client indicated that the standard delivered report does not meet their business requirement. You recommend that they create a new report using the Financial Report Writer.

Which four statements are TRUE regarding the Financial Report Writer?