You need to configure credit card processing for all three companies.

Which option should you use? To answer, select the appropriate options in the answer area

NOTE: Each correct selection is worth one point.

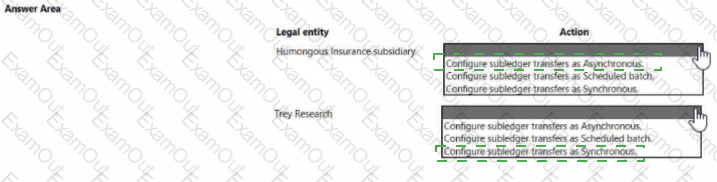

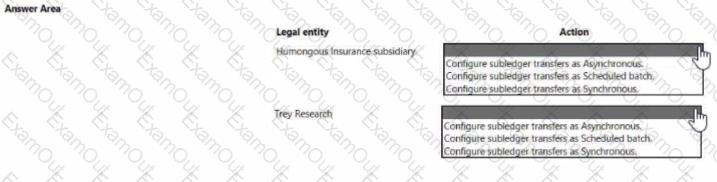

You need to ensure accounting entries are transferred from subledgers to general ledgers.

How should you configure the batch transfer rule? To answer, select the appropriate options in the answer area.

NOTE: Each correct selection is worth one point.

You need to enforce financial budgets for management and resolve User As issue. What should you do?

You need to set up financial reports to meet management requirements. What should you do? Each correct answer presents part of the solution.

NOTE: Each correct selection is worth one point.

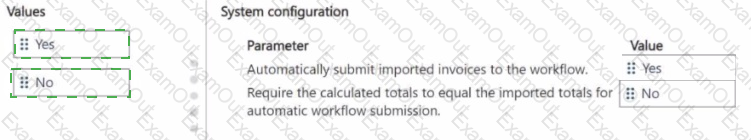

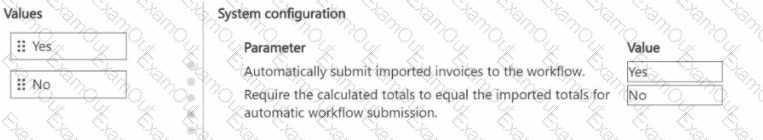

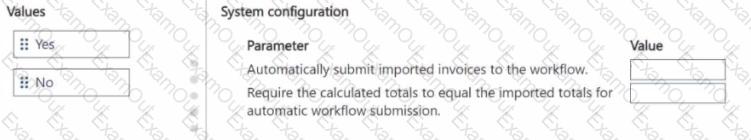

You need to resolve the accounts payable manager issue and resolve the user acceptance testing bug reported by the accounts payable clerk.

How should you configure the system? To answer, move the appropriate Value to the correct Parameter. You may use each Value once, more than once, or not at all. You may need to move the split bar between panes or scroll to view content.

NOTE: Each correct selection is worth one point.

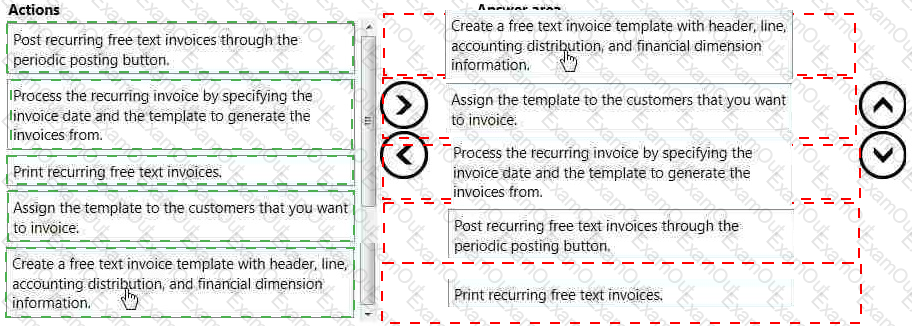

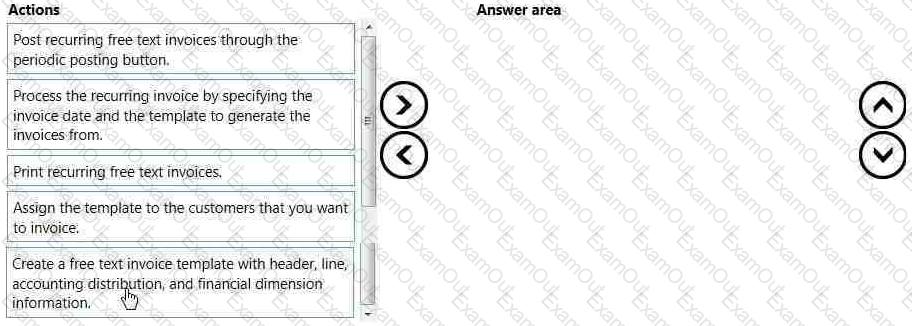

An organization sells monthly service subscriptions. The organization sends invoices to customers on the 15th of every month in the amount of $450.00.

You need to set up, configure, and process recurring free text invoices for the customers.

In which order should you perform the actions? To answer, move all actions from the list of actions to the answer area and arrange them in the correct order.

Note: This question is part of a series of questions that present the same scenario. Each question in the series contains a unique solution that might meet the stated goals. Some question sets might have more than one correct solution, while others might not have a correct solution.

After you answer a question in this section, you will NOT be able to return to it. As a result, these questions will not appear in the review screen.

You manage a Dynamics 365 Finance implementation.

You must provide the budget versus actual reporting in near real time.

You need to configure the ledger budgets and forecasts workspace to track expenses over budget and revenue under budget.

Solution: Configure an expense dimension set. Configure the set show amounts field value to per budget cycle.

Does the solution meet the goal?

A company uses the credit and collections features of Dynamics 365 Finance to track invoices and incoming payments from customers.

You need to configure the automatic collection task.

Which two options should you configure? Each correct answer presents part of the solution.

NOTE: Each correct selection is worth one point.

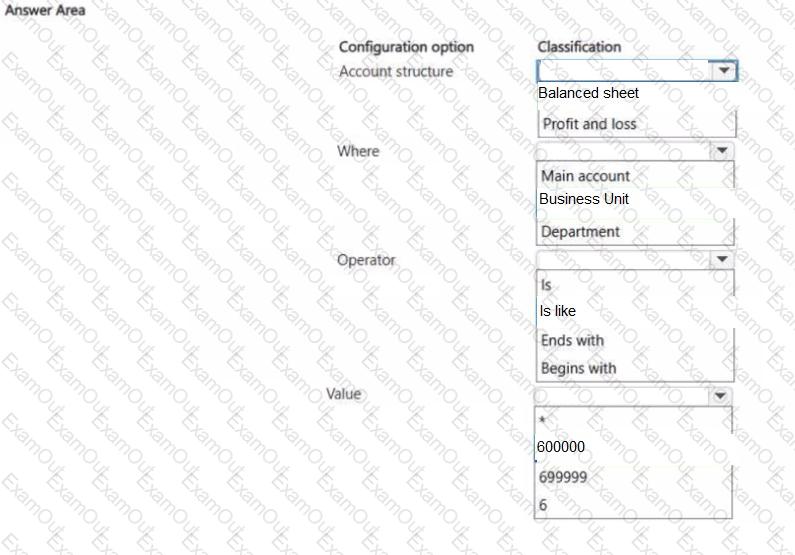

A company implements basic budgeting functionality in Dynamics 365 Finance.

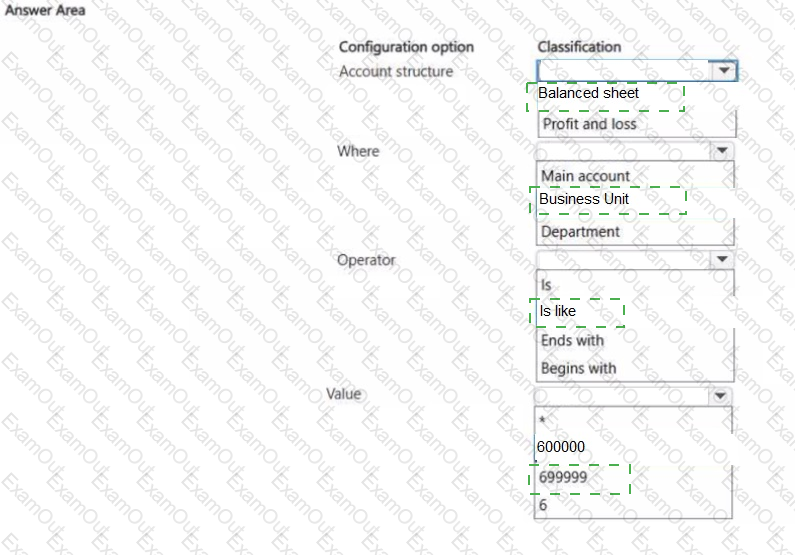

The company has 6-digit main account numbers. Two account structures are used as follows:

• Profit and loss, which includes main account for revenue and expense account.

• Balance sheet which includes main account for asset liability, and equity.

The accounts start with the following numbers:

Asset: 1

Liability: 2

Equity: 3

Revenue: 4

Cost of goods sold: 5

Selling expense: 6

Administration expense: 7

Other Income and expense: 8

The company allows budget transfers only between the selling expense account and revenue accounts.

You need to configure a budget transfer rule for the selling expense account.

To answer, select the appropriate option in the answer area.

NOTE: Each correct answer is worth one point.

You are configuring the basic budgeting for a Dynamics 365 Finance environment.

You need to configure the types of entries allowed.

Which two configurations can you use? Each correct answer presents a complete solution.

NOTE: Each correct selection is worth one point,