When evaluating a capital Budgeting proposal, an advantage of using the payback method is that Bits process

Sunnyvale Gas Company had a $50 million issue of 30-year mortgage bonds issued at par 10 years ago The coupon rate on the bonds is 15% and Interest is payable semi-annually on March 1 and September 1. The bonds are currently trading at SI 300. The can provision of the issue states that the bonds are callable after the S-year deferral period at 108 plus accrued interest. If Sunnyvale calls the bonds effective June 1 what is the cash payment, ignoring taxes, to the bondholders?

All of the following describe ethical leaders except

The best discount rate to the use for evaluate of investment opportunities is the

In an Enterprise Risk Management environment, which one of the following is the best example of risk sharing?

Which one of the following statements regarding portfolio diversification is not correct?

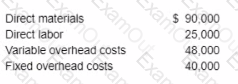

A company produces 10,000 units of Product A monthly at the costs shown below.

The company estimates that 30% of the fixed overhead costs allocated to Product A are avoidable if the company chooses to outsource the production If the company purchases Product A from an outside supplier for $18 per unit what would be the net effect on its operating income?

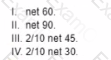

A company currently offers all of its customers trade credit with terms of 1/15 net 45 of the following alternatives which would not Increase the company's average collection period from its current level?

Slam-Dunk Shoes has 5,000 pairs or damaged shoes in inventory. The cost of these shoes was $51,000. in their present condition, the shoes may be sold at clearance prices for $29,000 Slam-Dunk can have the shoes repaired at a cost of $77,000 after which they can be sold for $100,000. What is the opportunity cost of selling the shoes in their present damaged condition?

The production process of a company s main product yields a by-product Production costs or $700,000 are incurred during this process and $300,000 m additional costs are incurred to finalize the main product. The by-product can be sold for $200 000 without further processing A manager proposed the conversion of the by-product into another product that would cost $100,000 and generate revenue of $250,000. When deciding on this proposal the company should