MJC Co. is considering adopting a variable costing system using variable costing rather than absorption costing will be more advantageous to MJC because the variable costing system

Edward Pane is an external auditor who is seeking an understanding of the cash receipts process at his new client Pane decides to use a flowchart to analyze the operations for efficiency and control. Which one of the following statements is true with respect to the decision to use a flowchart for this purpose?

Scully Tools Company is currently completing its master budget for the coming year Immediately before the master budget is approved, it is determined that December sales should be revised upward by S120.000 . Scully purchases merchandise on a just-in-time basis, and remits cash immediately through electronic transfer All sales are on account. 20% of the sales are collected in the month of sale, and 80% in the month following the sale. Scully's gross profit percentage is 30%. What effect will this budget revision have on Scully's pro forma statement of cash flows?

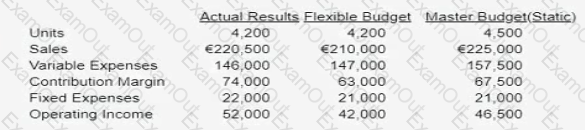

Anatolian Textile Company produces blue-jean pants for a globally known blue-jean brand and its annual financial results are shown below.

Based on the table the sales-price variance for the company is

in preparing Klein Corporation's master budget for the following calendar year, the manager of the Production Department requested the purchase of a new piece of machinery with a purchase price of $150.000 in addition, the cost of installing the machine would total $13.000. The purchase price of the machine would be financed by a 6%. 5-year loan with interest due quarterly. The amount Klein Corporation should include in its Capital Expenditures Budget due to this purchase is

Which one of me following statements is correct concerning the Sarbanes-Oxley Act of 2002?

Redstone, inc’s budget indicated that it expected to sell 30.000 units of Product A and 90.000 units of Product B Budgeted unit contribution margins were $4 for Product A and $22 for Product B Redstone's actual sales were 28.000 units of Product A and 72.000 units of Product B with actual unit contribution margins of $3 25 and S23 50. respectively. Redstone's sales-mix variance was

Identity two internal factors that enable the Food-To-Go division to have competitive advantages over Its competitors.

Essay

Food Depot Ltd (FDD is a privately-held company that provides catering services to airlines and operates several restaurant chains including fast food, casual dining, and fine dining restaurants FDL has been profitable m recent years and has a very strong cash position FDL's newest division. Food-To-Go. is an online meal ordering and delivery platform acquired by FDL two years ago.

In 20X7. sales for the entire company were SI billion, with 50% of the business coming from the Airline Catering division. FDL is the country's leading airline catering services provider and controls 60% of the market share. However, the outlook of the airline catering industry is gloomy. The compound annual growth rate of the industry for the past five years was only 0.5% as airline networks have increasingly dropped catering on short domestic flights.

The Food-To-Go division only contributed 5% of FDL's total sales in 20X7 and is far behind in competing for market share of the online meal ordering and deliver, industry. It is estimated that Food-To-Go's sales were only 20% of the industry leader's sales However, the outlook for the online meal ordering and delivery services industry is bright. The compound annual growth rate of the industry since it started three years ago was 50%. It is estimated the rapid growth of the industry will continue in the foreseeable future.

The costs of shared corporate services are allocated based on each division s revenue FDL usually caps its capital expenditure budget to 4% of budgeted sales revenue In a recent capital budget coordination meeting. Smith Whitney, the head of the Airline Catering division. complained that his division is underfunded on capital projects . The budgeted capital expenditure had been much less than 4 % of the division’s budgeted sales in the past three years He argued that his division is the company's best-performing division, and it needs more funds to maintain its market share m the industry Whitney wants to reduce the capital expenditure budget for Food-To-Go and reallocate those funds to his division.

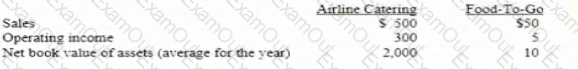

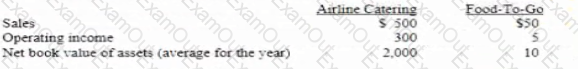

Susan Wiley, the bead of Food-To-Go, does not agree that the Airline Catering division is the best-performing division in the company Wiley argues that her division had the highest ROI in 20X7. and it deserves more capital funding FDL's required rate of return is 12%. The selected financial data for the Airline Catering division and Food-To-Go division in 20X7 are as follows (in $ millions).

Discuss Whitney's arguments for allocating more capital funds to the Airline Catering division.

Essay

Food Depot Ltd (FDD is a privately-held company that provides catering services to airlines and operates several restaurant chains including fast food, casual dining, and fine dining restaurants FDL has been profitable m recent years and has a very strong cash position FDL's newest division. Food-To-Go. is an online meal ordering and delivery platform acquired by FDL two years ago.

In 20X7. sales for the entire company were SI billion, with 50% of the business coming from the Airline Catering division. FDL is the country's leading airline catering services provider and controls 60% of the market share. However, the outlook of the airline catering industry is gloomy. The compound annual growth rate of the industry for the past five years was only 0.5% as airline networks have increasingly dropped catering on short domestic flights.

The Food-To-Go division only contributed 5% of FDL's total sales in 20X7 and is far behind in competing for market share of the online meal ordering and deliver, industry. It is estimated that Food-To-Go's sales were only 20% of the industry leader's sales However, the outlook for the online meal ordering and delivery services industry is bright. The compound annual growth rate of the industry since it started three years ago was 50%. It is estimated the rapid growth of the industry will continue in the foreseeable future.

The costs of shared corporate services are allocated based on each division s revenue FDL usually caps its capital expenditure budget to 4% of budgeted sales revenue In a recent capital budget coordination meeting. Smith Whitney, the head of the Airline Catering division. complained that his division is underfunded on capital projects . The budgeted capital expenditure had been much less than 4 % of the division’s budgeted sales in the past three years He argued that his division is the company's best-performing division, and it needs more funds to maintain its market share m the industry Whitney wants to reduce the capital expenditure budget for Food-To-Go and reallocate those funds to his division.

Susan Wiley, the bead of Food-To-Go, does not agree that the Airline Catering division is the best-performing division in the company Wiley argues that her division had the highest ROI in 20X7. and it deserves more capital funding FDL's required rate of return is 12%. The selected financial data for the Airline Catering division and Food-To-Go division in 20X7 are as follows (in $ millions).

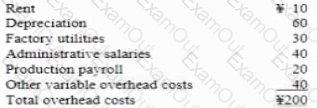

What is ZF's expected variable overhead cost per pound of food produced? Snow your calculations

Essay

Zhiliang Foods Inc. (ZFI) is a privately-held food distributor ZFI has two production departments' the Meat Department is labor-intensive. while the Bakery Department is highly automated ZFI applies a single overhead allocation rate, using the number of pounds produced as an allocation base for the whole company The expected annual overhead costs of ZFI for 100 million pounds produced are as follows (¥ in millions).

ZFI has one payroll administrator in its Human Resources department, but most of the payroll related work is outsourced to a payroll service provider ZFI's payroll administrator is responsible for tracking the list of current employees and maintaining the most up-to-date employee information, including bank accounts for payroll direct deposits.

Each pay period, the payroll administrator emails the information for all current employees' hours worked to the payroll service provider. The service provider then processes the payroll, makes direct deposits to employees' bank accounts, mails payroll stubs to employees' homes and emails payroll reports to ZFI's payroll administrator. The payroll administrator then makes payroll journal entries to ZFI's accounting system based on the payroll reports received ZFI's accountant prepares a bank reconciliation each month to ensure ZFI s payroll payments on ZFI's bank statement match the amounts shown on the payroll reports from the service provider.

ZFl's management is evaluating the purchase of data encryption software and human resources management software next year. The human resource management software is expected to provide various human resources and payroll-related functions.

In addition, the human resource software can generate a report to indicate the monthly employee turnover rate and the average service length of employees who have resigned. The system can also generate a report to indicate the main reasons for resignations and identify current employees who are at risk of resigning. The system will recommend actions to help retain these employees, such as more training opportunities or a pay raise.