Catarina is a Dealing Representative for Ethical Financial which represents 20 different mutual fund families. Darlene is a fund manager from one of those mutual fund families and wants to send a gift card to Catarina as a symbol of appreciation. Ethical Financial's policies and procedures manual (PPM) require that Catarina decline the gift.

What method of addressing conflict of interest is being used by Ethical Financial?

You are concerned about upcoming weakness in the Canadian dollar. Which type of fund should you invest in?

Dakota is a Dealing Representative with Harvest Wealth Inc., a mutual fund dealer. Dakota starts a marketing campaign to contact prospective new clients and increase sales with existing clients. Which of the following CORRECTLY describes activities that Dakota can engage in under her marketing campaign?

Salvatore and Harriet recently got married. They are presently renting but are looking forward to buying a new home within 5 years. They both have separate savings established in their respective registered retirement savings plans (RRSPs) of $100,000 each. They have come to Dustin, a Dealing Representative, to open an additional joint investment account to increase their savings to assist with their future plans of buying a new home.

What does Dustin need to ensure about his recommendation?

What does suitability mean?

What bias would influence an investor’s decision to continue to hold an unprofitable investment despite little likelihood of an improvement in the investment’s value?

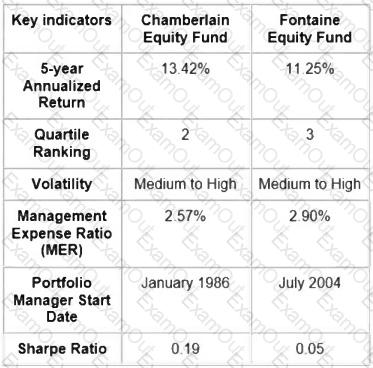

You have been researching Canadian equity mutual funds for a new client. You come across the following information.

What can you conclude from this information?

Why do speculators tend to avoid diversification?

You wish to sell a perpetual preferred share with a par value of $25.00, which pays a quarterly dividend of $0.25. If other preferred shares of similar quality are currently yielding 3.5%, what price should you expect to receive for your share?

Who is responsible for the explicit costs of operating a mutual fund?