The financial statements are produced in accordance with relevant accounting standards. This compliance ensures the requirement of fair presentation of transactions and events is met

How is this compliance emphasized?

Refer to the exhibit.

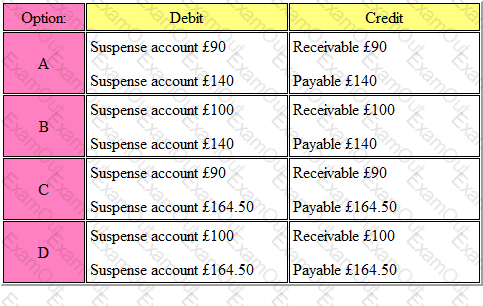

The following book-keeping errors were discovered:

1. A cheque for £900 received from a receivable, after deduction of 10% cash discount, had been correctly entered in the bank account and discounts allowed accounts, but only the actual amount received had been entered in the receivable's account

2. An invoice for £940, including VAT at 17.5%, had been correctly recorded in the purchases and VAT accounts, but only the net goods value had been entered into the payable's account.

Which of the following options provides the entries necessary to correct the above errors?

The answer is:

Different users have different needs from financial information. One of which is to know about the company's ability pay its debts

Which of the following users will have this need for information?

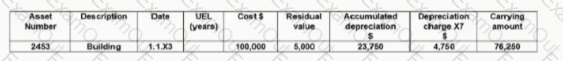

DE has the following incomplete non-current register extract at 301 at December 20X7:

What is the useful economic life (UEL) (in years) of this asset which should be entered into the non-current asset register?

A business will maintain a non-current asset register to keep a record of all non-current assets held.

Which THREE of the following are examples of information contained within the register?

Which one of the following internal controls is designed to prevent errors and fraud?

Published accounts must include the following statements:

A business buys a new production line at a cost of £100,000. After using the line for one year a more advanced version of the line is marketed by the manufacturer. As a result the production line in operation has a market value of £ 50,000. The line is being depreciated straight line over five years.

The charge to the income statement for impairment of the production line will be

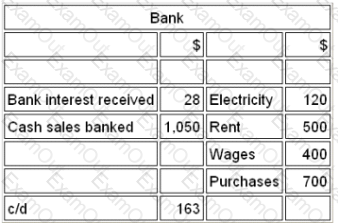

Refer to the Exhibit.

Which of the following would be shown in the trial balance for the bank ledger account?

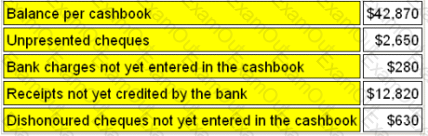

Refer to the Exhibit.

The Financial Accountant for a company is preparing the monthly bank reconciliation and has extracted the following information:

The correct cash book balance at the month end will be: