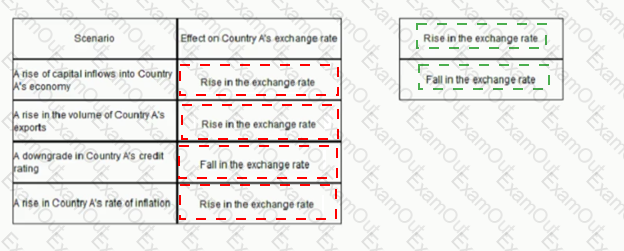

Assuming Country A has a floating exchange rate which of the following would lead to a fall of the exchange rate for Country A and which rise m the exchange rate for Country A.

Complete the table below by matching the relevant label on the exchange rate of the scenarios listed.

A government issues a security which promises to pay $100 per year indefinitely. What is it worth if the required rate of return is..

Which of the following equations is correct regarding interest rates?

A forward exchange contract would be appropriate (or a company that

A business has a short-term problem with its payments exceeding its receipts. Which TWO of the following would be appropriate for meeting this financial shortfall?

If the production of a good involves an external social cost, resource allocation could be improved by:

Which global financial institution is responsible for making long term loans to assist developing countries to invest and develop?

Which of the following is not taken into account by the discount factor applied to future earnings when calculating shareholder value?

Select the best definition of a regressive tax from the options below:

An important distinction between a free trade area and a customs union is that