Making payments through electronic payments networks can be a part of a treasury management system’s functionality, but it is subject to numerous constraints. Which of the following is a true statement of those constraints?

Which of the following would be true for a company with high operating leverage?

Private companies usually go public by making an initial public offering. What is the term for offering subsequent shares in the market?

A retail brokerage firm is MOST like which one of the following types of financial institutions?

Company XYZ has an underfunded defined benefit plan. Company XYZ is required to provide filings for this plan to all of the following EXCEPT:

BEA Company has determined its breakeven dollar amount for concentrating remote funds is $550.00. BEA Company has a daily earnings rate of 6% and gains one day of accelerated funds. If a wire costs BEA $35.00 dollars, what is the cost of an electronic funds transfer for BEA Company?

All of the following are examples of treasury management system transactions for liquidity management EXCEPT:

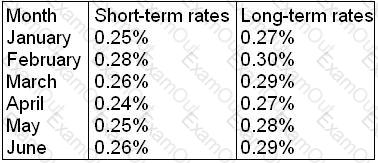

A company has decided to manage its short-term investment portfolio in-house. It is looking for enhanced capital gains as well as the ability to sell the instruments on the secondary market at a premium. The investment manager has forecasted the interest rates shown below:

Which investment strategy should be employed by the company?

Which of the following contributes MOST to the marketability of a security?

A company has a $2 million line of credit requiring a 5% compensating balance on usage. For the next year, the company projects a usage of 75% and a 10.375% interest rate. If the balance requirement is eliminated, by how many basis points will the company's effective interest rate be reduced?

Which of the following would be the most efficient method of reducing the number of cross-border payments between two units of a company?

The future value of $60 invested at 8% compounded per year for three years is:

Which of the following statements is true about lockbox network systems?

Compared to debt, which of the following statements is true about a company issuing equity?

The time between the payor's mailing of a check and the payee's receipt of usable funds is known as:

Which of the following factors is NOT used by a cash manager to estimate a target compensating balance?

A PRIMARY objective of the cash concentration function is to:

Which of the following investment instruments would provide a company with the greatest liquidity and least risk?

A cash manager invests in Treasury bills for which of the following reasons?

A convenience store chain would typically use which of the following types of collection systems?