Which is the MOST expensive capital structure for a growing technology firm? Assume a tax rate of 32%.

Which of the following is indicative of a consolidated operation?

XYZ Company's cash manager is evaluating cash concentration transfer options. The company has an 8% cost of funds and $50,000 in average daily field cash receipts. The wire transfer results in the transfer of funds one day faster. Which of the following options correctly ranks the transfer choices from most cost-effective to least cost-effective?

1. Electronic depository transfer costing $1.00

2. Electronic depository transfer costing $2.50

3. Wire transfer costing $8.00

4. Wire transfer costing $15.00

The treasurer at Company ABC would like to assess the quality of the company's A/R at an aggregate level by knowing how long the company takes to convert a credit sale into cash. Identify which method the treasurer should use and calculate the result by using the following information regarding Company ABC:

Annual Revenue = $4,500,000

Annual Credit Sales = $3,800,000

Accounts Receivable = $800,000

Which one of the following is true of capital repatriation for multinational companies?

A company plans to double its dividend to its shareholders. Which of the following characteristics of the company would be MOST affected by this increase?

The risk of one bank failing and endangering the liquidity of other banks is called:

Which of the following is a PRIMARY responsibility of a company's risk management function?

A put option is out of the money when the asset price:

Based on the data set, how much money will ABC Company owe the bank for monthly service charges after the earnings credit is applied?

A U.S. company has 50 bank accounts from which it issues check payments. In order to more accurately determine its daily cash position, which of the following bank services should be implemented?

A company is expanding its investment portfolio to include external managers. All managers place trades through a company account so that detailed investment reports can be generated. What is the BEST method to adopt for accurate tracking and reporting of investment activity and to reduce the potential for fraud?

A treasury manager at a multinational manufacturing corporation assigned a team of analysts to re-engineer the company’s FX exposure management program. Which of the following alternatives would BEST accomplish this objective?

Which of the following is a tool that companies use to obtain a quantitative rating of a financial institution’s level of service?

Which of the following actions would the CFO of a Canadian multinational conglomerate MOST LIKELY take to repatriate profits from its international subsidiaries?

An analyst is performing a lease versus buy analysis on a corporate jet. In the evaluation, a cost is relevant if it is:

Recently LEW Utilities, a local utility company, began using the company processing center method to process customer payments. Prior to this change, it used its local depository bank’s lockbox to process the payments. The PRIMARY advantage of the new method is to:

A manager has prepared an analysis of five investment alternatives. Prior to selecting which alternative to invest funds in, the manager calculated the anticipated return for all options. The manager is only going to invest in one alternative. The four investments that are not chosen are:

EDI infrastructure includes which of the following four PRIMARY components?

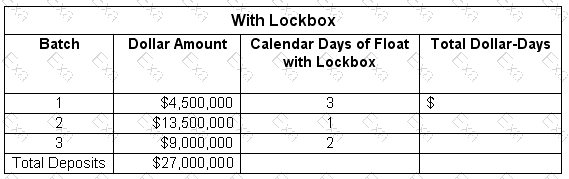

An analyst at XYZ Company was assigned with determining if the company should start to use a lockbox provider for its retail payments. The analyst determined that the company’s annual sales of $324,000,000 were recorded evenly throughout the year. The Company receives 30,000 checks annually. Total dollar-days float without the lockbox is $76,500,000 and the annual opportunity cost is 5.5%; assume 30-day month. The industry’s average opportunity cost is 6.0%. Using the information in the table, what would be the net effect of using the lockbox?