Stock A & B are positively correlated with a correlation co efficient of .75. When stock A moves up by 12%, how will stock B perform?

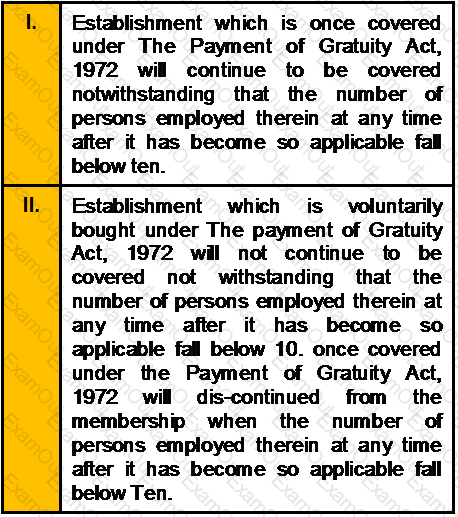

Which of the following statement is not true?

Which of the following statement is true?

Negative amortization leads to ______________

The approved superannuation fund has to deposit all the contributions received from the employer

Financial intermediaries

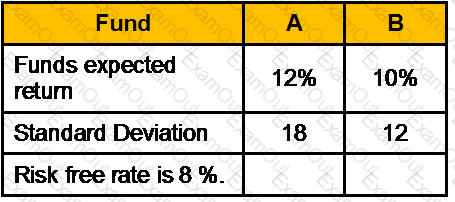

The following parameters are available for two mutual funds:

Calculate Sharpe measure?

Consideration' under the law is a return promise to:

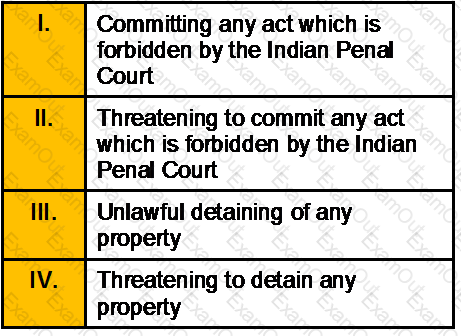

A contract is said to be caused by coercion when it is obtained by:

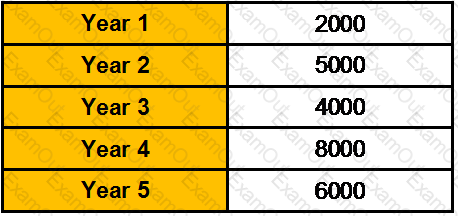

An investment required an initial cash outlay of Rs. 15,000/- and yield cash flows over the next 5 years. The cash flows generated are:

You are required to calculate the payback period:

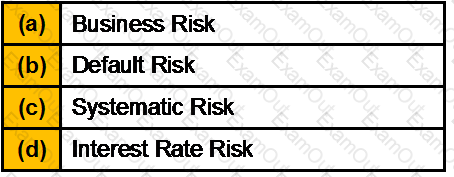

A mutual fund that invests in Indian Equities, foreign equities, Indian Corporate Bonds, Indian Government Gilts is subject to the following risks?

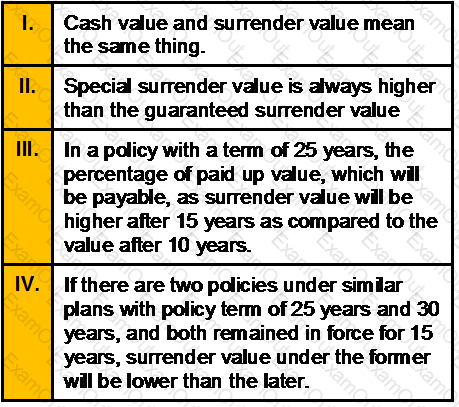

Which of the following statement is false?

Which one of the following statements is/are correct?

Investment made in a stock 2 years ago is Rs. 175; the current value is Rs. 250. The dividend received at the end of 2nd year is Rs. 40. What is the CAGR?

An increase in the market value of a company indicates:

Expenses are 10% of the gross (office) premium. Pure premium is Rs. 200. Calculate office premium.

Akash has only compulsory third party policy for his car. He jumped a red light and collided with another car and then with the boundary wall of a nearby house. Damage to his car was of Rs. 17,000/-, damage to other car was of Rs. 15,000/- and damage to the boundary wall of house was of Rs. 15,000. The insurance policy of Akash will pay:

Ram born in 1950 has a life expectancy at birth of 65 years. Sita his wife born in 1955 has a life expectancy at birth of 70 years. Assuming that the life expectancies have not changed. Ram is planning to buy an annuity to be paid to him or his wife till anyone of them is alive. Assuming Ram will retire on attaining age 58 i.e. in 2008, what should be the time period of the annuity?

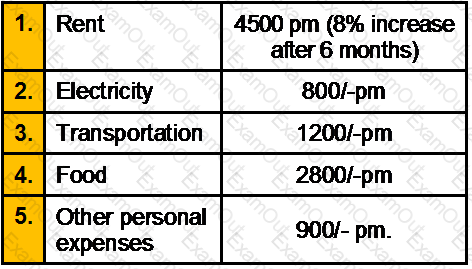

Suresh a 30 years old person has joined ABHG on 1/07/2006. His monthly salary (net salary) after deduction is payable Rs. 20500.His monthly expenses details are as follows:

Assume that Suresh has taken his flat on rent from 01/07/2006. On 01 /07/2006 he has cash in hand Rs. 2450. What will be his cash in hand on 31/03/2007.

Minimum net-worth of an AMC should be ______