In Islamic Banking, Anything permitted by Shariah is called:

According to the capital asset pricing model, fairly priced securities have __________.

Under the current international monetary system,

International Development Association is an agency of _____

A firm’s earnings decline because of a strike, this is an example of:

Onshore wealth management involves ____________

The Capital Asset Pricing Model:

In case of an individual and HUF cash in hand in excess of …………… shall be included in assets

The Indian Taxation System by nature is...........

Gilt schemes are a type of

Assessing client’s level of risk tolerance is done while

Performance measurement by benchmarking normally refers to comparing performance of a fund to

In case of fire insurance, insurable interest should exist at the time of

The person making the proposal is called

“Income rule” in Insurance advocates

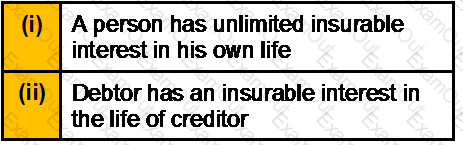

Which one of the following is correct?

_______________ and _______________ mandates are two kinds of service level contracts

Seigniorage is ____________

Which of the following statement (s) is/are true about the rate risk?

Which is not the condition for getting superannuation fund approved?