Indexed cost of acquisition is calculated by

A)

B)

C)

D)

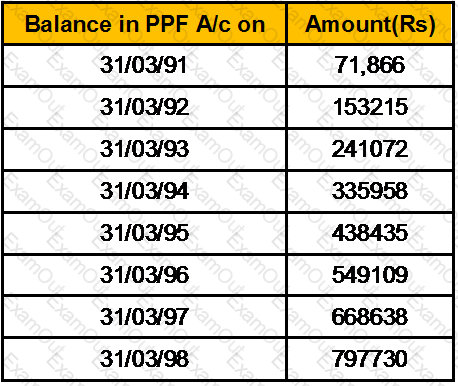

Vinod opened the PPF account on 19/11/2000, Calculate the amount he can avail as the first loan facility from the details below?

Balance on current account + balance of capital account + balance on reserves account is equal to ___________

Dinesh is entitled to a basic salary of Rs. 5,000 p.m. and dearness allowance of “Rs. 1,000 per month, 40% of which forms the part of the retirement benefits. He is also entitled to HRA of Rs. 2,000 p.m. He actually pays Rs. 2,000 p.m. as rent for a house in Delhi. Compute the taxable HRA

The employer had purchased a car for Rs. 3,00,000 which was being used for official purposes. After 2 year 6 months of its use, the car is sold to R, the employee, for Rs. 1,20,000. The value of this perquisite shall be

If you have deposited Rs.4000 with a company and the company wishes to prepay the deposit at the contracted rate of interest after a period of 3.5 years and offers you Rs.4985, what is the effective rate of interest if it is accounted half yearly?

CAMELS framework was first used in _______.

A Treasury bill pays a 6% rate of return. A risk averse investor __________ invest in a risky portfolio that pays 12% with a probability of 40% or 2% with a probability of 60% because __________.

Find out the effective quarterly rate for 18% per annum compounded half yearly.

Mr Ram aged 53 years has put in 21 years of service in a PSU opts for a voluntary retirement under the company scheme. He has 5 years and 3 months of service left and his last drawn salary is Rs 18,000. He received Rs 10,00,000 as compensation. What would be the taxable part of this receipt?

What is the minimum number of persons who must subscribe to the memorandum of association?

The main purpose of the guaranteed insurability rider benefit is to give the policyholder the right to

Encashment of leave during service tenure is

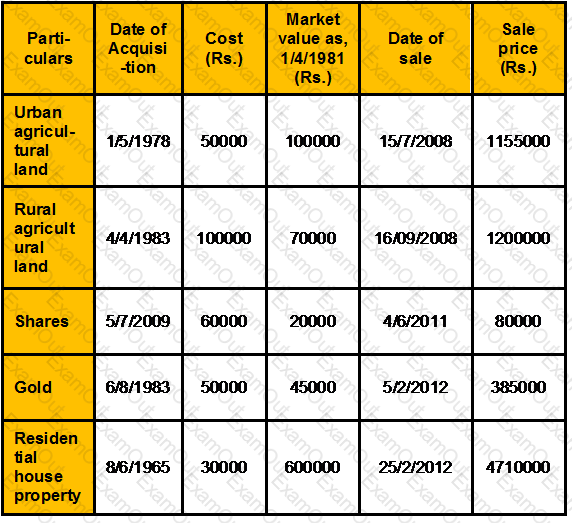

Sunil submits you the following particulars:

Purpose of budget is ____________

A Family consists of karta, his wife four sons and their wires and children and its income is Rs. 1000000 if by family arrangement income yield property is settled on karta his wife and sons & daughter in law than tax liability would be

A trust is created by a son, the Settlor, for the survival expenses of his retired parents each having equal beneficial interest. Both husband and wife have separate fixed pension of Rs.35,000 per month and Rs. 20,000 per month, respectively. The trust property has generated a net annual value of Rs. 5.12 lakh in the previous year 2012-13. The trustee as well as the Settlor is in the 30% tax bracket. Find the tax payable by the trustee as representative assessee.

Sujoy has purchased shares of Rs.12500 of common stock in Hindustan Unilever . He has recently sold investment to the tune of Rs.15000 & received Rs 2500 as cash dividends during the holding period of 4 years. He paid a total of Rs 250 in commissions. What is CAGR on the investment?

The difference between aggregate disbursements net of debt repayments and recovery of loans and revenue receipts and non debt capital receipts is called:

Vikrant Juneja gifted his house property to his wife in year 2007. Mrs. Juneja then lets out this house @ Rs. 5000 per month. The income from such house property will be taxable in the hands of: